Important Tax Information:

- Tax bills for the upcoming 2024 Town and County tax collection will be mailed the last business day of December 2023

- Property owners who pay their taxes directly and DO NOT receive their tax bill by January 12th should contact the Town of Perinton Tax Office at (585) 223-0770 or visit the Monroe county website at www.monroecounty.gov for a printed copy

- In the event that the due date falls on a weekend or holiday, payment will be accepted on the first business day after the weekend or holiday

Payment Schedule:

Full Payments:

- Full payments are due on or before February 10th (interest free)

- Full payments made after February 10th will accrue interest at the rate of 1.5% per month

Installment Payments (all installment payments may be made at the Town Tax Office):

- First installment payment is due on or before February 10th (interest free)

- Second installment is due between February 11th – 28th (includes 1.5% interest)

- Third installment is due between March 1st – 31st (includes 3.0% interest)

- Fourth installment is due between April 1st – 30th (includes 4.5% interest)

*Instructions for payment are included on the back of the first page of the tax bill. The proper payment stub must accompany payment.

Payment Options:

- By check or cash in person at the Town Tax Office (9AM-5PM, Monday through Friday)

- By check via mail (receipt date determined by U.S. postmark only)

*Online Bank Payments – Online bank checks arrive in our office with no U.S. postmark so we must go by the day it arrives in office. Banks discourage the use of online banking for tax payments because they cannot guarantee your payment will be delivered to our office by the due date. If you utilize online banking, you do so at your own risk

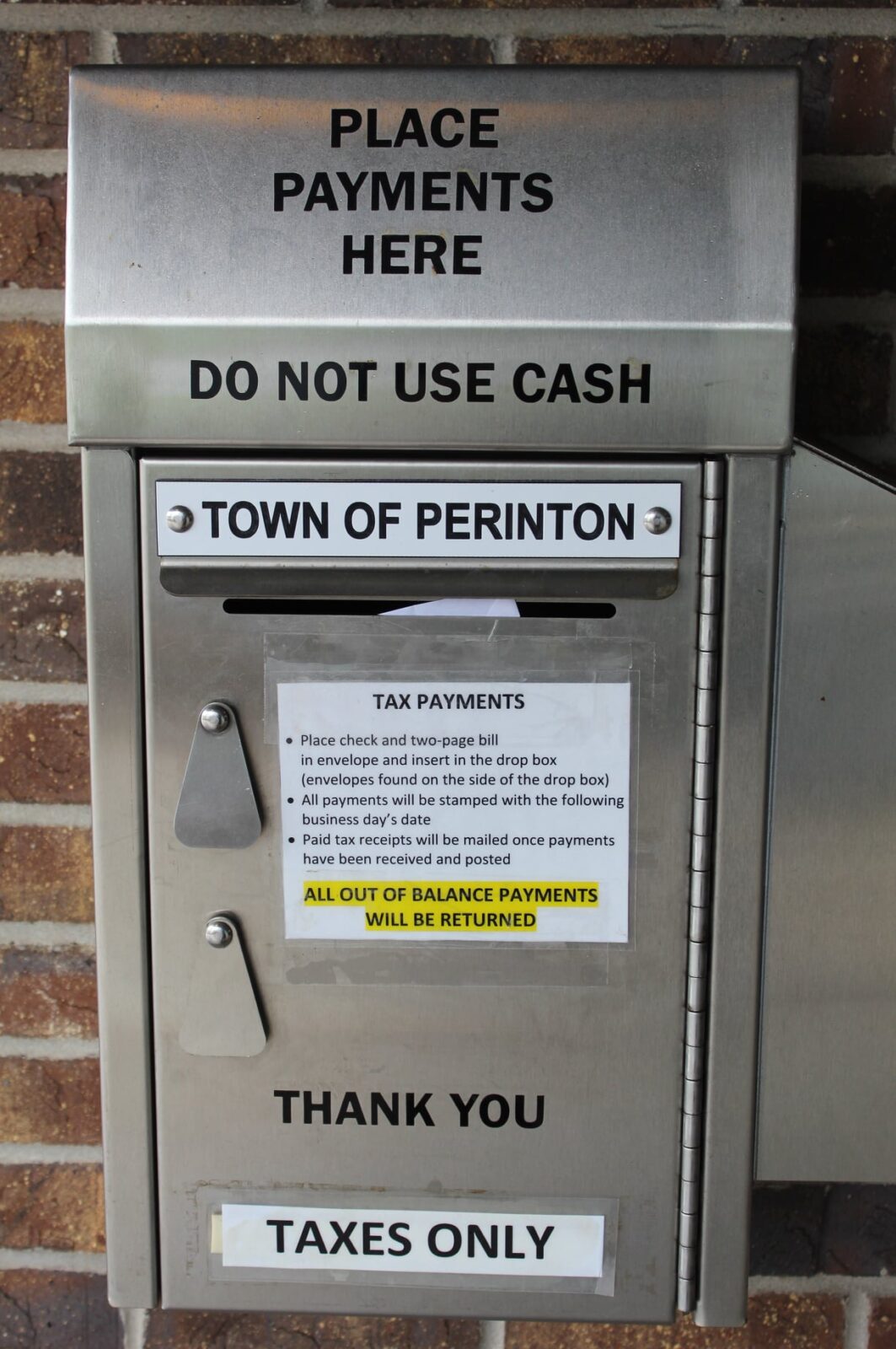

- By check in the Town Tax Drop Box located out front of the Town Hall – open 24 hours (Must be in tax drop box by end of day on tax due dates to ensure no additional interest

- By credit card online at www.monroecounty.gov – A fee equaling 2.75% of the total amount paid for any transactions greater than $100 will be charged by the credit card company when paying by credit or debit card. Payments of $100 or less will be charged a flat fee of $2.75

- By electronic check online at www.monroecounty.gov – A sliding scale fee is charged based on the amount of payment

All payments are made payable to DEBBIE D. BROWN, RECEIVER OF TAXES

Please contact our office at any time if you have any questions or concerns.